Average Retirement Income 2025: How Do You Compare?

Average Retirement Income 2025 is the starting point for figuring out how you’re going to pay for retirement—and how everyone else is affording it. What does the typical retiree earn in 2025? Has that changed much from previous years? With inflation cooling, the stock market on the rebound, and housing prices stabilizing (but still high), have retirement incomes kept up? And are you anywhere close to the average? Let’s dig into the numbers and find out.

What’s Changed in 2025?

The economy in 2025 has brought mixed results for American households. Inflation has cooled from its peak but remains stubborn in certain sectors. The stock market is recovering, but volatility still lingers. Housing prices have stabilized, yet they remain out of reach for many. As usual, wealthier households have adapted, while those with fewer resources continue to feel the pinch of rising costs.

So where do you stand in 2025? Have you been able to keep saving? And what does that mean for your future retirement income?

It’s hard to know how secure your future is without digging into the numbers. Benchmarking yourself against national averages is a good starting point. But, it’s just that: a start. The best way to find real clarity is with a personalized retirement plan. The Boldin Retirement Planner offers detailed, customized projections to help you plan confidently and securely. These retirement income projections help you model future income based on personalized scenarios.

Average Retirement Income and the Risk of Running Out of Money

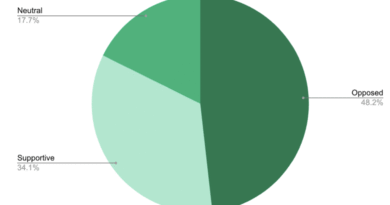

The National Retirement Risk Index (NRRI) from the Boston College Center for Retirement Research reveals that nearly 50% of U.S. households are at risk of not having enough retirement income to maintain their pre-retirement lifestyle, according to their 2023 analysis.

This reflects ongoing concerns about inadequate savings, longer lifespans, and rising healthcare costs. Recent NRRI reports also highlight:

- Rising housing costs as a growing retirement risk factor.

- Disparities by income level, with lower-income households facing the highest risk.

- Minimal improvement in retirement readiness despite strong market performance in some years.

Even if people work until age 65 and annuitize all financial assets (including home equity), many will still fall short. The problem isn’t new—it’s systemic. Unless access to employer-sponsored retirement plans becomes universal, savings shortfalls will persist. This highlights a persistent retirement readiness gap and an insufficient retirement income replacement rate for many U.S. households.

According to the U.S. Bureau of Labor Statistics, the median weekly earnings for full-time workers in Q1 2025 was $1,194, which translates to an annual income of approximately $61,984. This figure reflects pre-tax earnings for full-time wage and salary workers across all industries. It serves as a useful benchmark for evaluating individual earnings, retirement readiness, or cost-of-living comparisons.

Differences Between Mean and Median Income

Mean income is the total income divided by number of households. It’s skewed by high earners and often overstates the “typical” retiree’s situation.

Median income, the middle value, offers a clearer picture. It tells us what most retirees are actually living on.

Average Retirement Income Falls as Households Get Older

For most people, retirement income drops sharply with age. Households over 75 earn less than half the income of those aged 55–64 and far less than those in the 45–54 range. The financial picture gets leaner as the years go on. Compare the median income by age range:

| Age of Household | Median Income | Median Post Tax Income |

| Households Aged 45–54 | $97,089 | $85,444 |

| Households Aged 55–64 | $75,842 | $66,638 |

| Households Aged 65–74 | $55,474 | unknown |

| Households Aged 75 and Older | $36,925 | unknown |

Average retirement Income for Single Female Households

Declining income with age is troubling enough, but it’s even worse for singles, especially women. According to the Pension Rights Center, half of all Americans age 65 or older live on less than $25,000 a year — a figure well below what most people need to cover basic living and healthcare costs. The income gap is even more severe for those without a partner to share expenses.

The 2020 Census Data shows this for non-family (single) female households:

| Age of Household | Median Income | Mean Income |

| Households Aged 65-69 | $28,311 | $39,945 |

| Households Aged 70-74 | $26,558 | $37,159 |

| Households Aged 75 and Older: | $21,666 | $32,233 |

Average Monthly Retirement Income by State

Age plays a big role in retirement income—but where you live matters just as much. National averages can be interesting, but they don’t always reflect your reality. Cost of living and income levels vary widely from state to state and city to city, making local data far more relevant for planning your retirement.

National averages for retiree income range from about $22,000 in lower-income states to over $36,000 in higher-income states. That’s a massive gulf—with major implications once you factor in local costs of living, state income taxes, and access to affordable healthcare.

For example:

- In Arkansas, the average annual retirement income is just $21,967. With lower wages and fewer employer-sponsored retirement plans, many retirees in the state rely heavily on Social Security alone.

- Compare that to Alaska, where the average retirement income is $36,052—driven by a higher cost of living and stronger public sector pensions.

Other notable examples include:

- California: $34,723

- Colorado: $32,418

- Florida: $30,220

- Alabama: $24,967

These averages can paint a misleading picture if you’re not accounting for local context. For instance, $30,000/year might be manageable in Oklahoma, but could mean financial hardship in New York or Hawaii, where housing and healthcare costs are far higher.

See How Your Income Stacks Up Locally

Want to know how your income compares to others in your area? Understanding retirement income by cost of living is critical when comparing across states or considering relocation. The U.S. Census Bureau lets you explore average income and demographic data by ZIP code. While it can be useful to see where you stand relative to your neighbors, remember: the most important benchmark is whether your income meets your retirement needs.

How to Use the Census Bureau Tool:

Visit the Census Bureau’s data search tool. Enter your ZIP code—either where you live now or where you’re considering moving for retirement. Then choose from the available data, such as “median household income,” to get a snapshot of your local income landscape.

When it comes to household income, where you live matters — a lot. The gap between the highest- and lowest-earning states in the U.S. is wide enough to dramatically affect your retirement outlook.

How to Increase Your Social Security Income

Looking to get the most out of your Social Security benefits? When it comes to Social Security benefits in 2025 here are two smart strategies and how to optimize them:

1. Delay Claiming Benefits

Waiting until full retirement age — or even better, age 70 — can significantly increase your monthly Social Security payments. Delaying benefits means a bigger check for life, which can translate into tens of thousands of dollars in added income over retirement.

More retirees are catching on: While age 62 used to be the most common starting point, that’s shifting. Today, the most popular age for men to claim is 66 (36% start then), followed by 62 (27%). For women, it’s a tie — 31% claim at 62, and 31% at 66.

2. Optimize for Both Spouses

If you’re married, focus on the higher earner’s benefit. Delaying that benefit can provide the surviving spouse with a larger monthly income down the road — an important factor given that many retirees live alone later in life, often with limited income.

Want to dive deeper into smart strategies? Learn more about Social Security planning for couples.

How Much Retirement Income Can Your Savings Generate?

Using the traditional — though often debated — 4% withdrawal rule, a nest egg of $164,000 (twice the national average savings) would generate just $6,560 in your first year of retirement.

That’s far from enough to support most households, especially when factoring in housing, healthcare, and everyday expenses. It’s a clear reminder that savings alone may not be enough — and that smart planning and additional income sources are essential. This includes tapping retirement income from 401(k)s, IRAs, and other personal savings vehicles like annuities.

How to boost your income from savings

This is easy… save more! Okay, maybe not so easy.

- If you are young, max out your 401(k) contributions and start an IRA. Keep up the contributions, and you’ll have a tidy sum when you retire.

- If you’re midway through your working years, it’s a little tougher. Be careful about what you spend on family in this phase of your life. Try to focus on making catch-up contributions.

- Retired or almost retired? Perhaps the best way to boost your retirement income from savings is to actually spend less or work longer! Your savings will last a lot longer if you are spending less (here are 20 ways to cut retirement costs).

You may also want to explore the best way for you to turn your savings into retirement income. Or, explore using a bucket strategy. It maximizes the growth of some of your assets while minimizing risk on others.

Working with a financial advisor to identify opportunities to efficiently turn assets into income can be another good opportunity for you. Boldin Advisors is a new, cost-effective, and comfortable way to work with a Certified Financial Planner.

Or, model different scenarios using the Boldin Retirement Planner to find a set of inputs and opportunities that give you a secure future.

Average Retirement Income from Pensions

According to the Pension Rights Center, only about one in three older adults receives income from a pension — and that number is steadily declining. If you have a pension, consider yourself fortunate.

Why? Because retirees with pensions often have twice the income of those relying solely on Social Security.

Pension Benefit Amounts Vary Widely by Source:

- Private pensions: Median of $9,262 per year

- State or local government pensions: $22,172

- Federal government pensions: $30,061

- Railroad pensions: $24,592

These benefits can make a major difference in retirement security.

How to Boost Your Pension Income

You cannot exactly boost your pension payments. You can make sure that you are making the right choice between getting monthly payments vs a lump sum. Additionally, you should periodically check with your plan administrator about the health of the funds. Many pensions are underfunded.

If you are lucky enough to have a pension, be sure to use a retirement calculator with pension controls to accurately factor your pension into your overall plan! The Boldin Retirement Planner fits the bill!

Average Retirement Income from Work

Even in retirement, a significant number of Americans continue to work. As of early 2024, approximately 22% of adults aged 65 and older remained in the workforce, a figure that has nearly doubled since the 1980s.

In 2022, the median income from work for retirees varied by age. Those aged 65–69 earned a median of $21,760, while individuals aged 70–74 made approximately $25,650, and those 75 and older earned about $24,450.

This additional income can be meaningful, but it’s rarely enough to rely on for full retirement funding. Despite relatively modest earnings compared to pre-retirement levels, work income still plays an important role for many older adults. It can help with out-of-pocket health care costs, cover living expenses, or stretch retirement savings. However, with only around one in five retirees working, employment generally supplements—rather than replaces—other sources of retirement income such as Social Security, pensions, and personal savings.

How to Boost Retirement Work Income

Delaying your retirement is the first option you might want to look at. Or, if you don’t already have a retirement job, you should consider one. It doesn’t need to be a 9–5. It does not need to be high stress. In fact, you should look for work that you really enjoy doing and let the income be a bonus.

Any work income is going to be tremendously beneficial — both financially and for your intellectual and social well-being as well. Explore the benefits of work after retirement and the best jobs for retirees. You may also want to explore passive retirement income options to supplement work or savings.

Use the Boldin Retirement Planner to see how work income impacts your long term financial health. Try different scenarios with different levels of work income over varying time periods to discover your optimal plan.

Frequently Asked Questions About Average Retirement Income in 2025

A: The average total retirement income in 2025 is approximately $54,000 per year. This includes about $24,000 from Social Security benefits and the rest from savings, pensions, or part-time work. The median is closer to $47,620, which better reflects typical retiree income.

A: The top sources of retirement income include Social Security benefits, income from 401(k)s and IRAs, pensions, part-time work, and personal savings. Many retirees also rely on home equity or passive income streams.

A: To increase your retirement income, delay claiming Social Security benefits, contribute more to retirement accounts, consider part-time work, and explore annuities or passive income options. Use a retirement income planner like Boldin to model your strategy.

A: The retirement income replacement rate is the percentage of your pre-retirement income that you need to maintain your lifestyle in retirement. Most experts recommend aiming for 70–80%, though your ideal rate depends on your expenses and location.

A: Based on average savings of $104,000, a 401(k) may provide about $4,160 per year using the 4% withdrawal rule. To increase this, maximize contributions and consider Roth or IRA rollovers.

A: Mean income is the average across all households, often skewed higher by wealthy retirees. Median income is the middle value and is usually more accurate for evaluating typical retiree finances.

A: Retirement income varies widely by state due to cost of living, local taxes, and pension availability. For example, retirees in Mississippi average around $22,000 per year, while those in Alaska average over $36,000.