Citi Strata Elite Credit Card Review (New Card Launched: 80k Offer)

Application Link

Benefits

- 80k Welcome Bonus: Earn 80,000 ThankYou Points (TYP) after spending $4,000 within the first 3 months of account opening.

- We value TYP at 1.6 cents/point, making the welcome bonus worth approximately $1,280!

- Points Transfer: Points earned from this card can be transferred to airline and hotel partners. You can also redeem them for cash at a fixed 1 cent/point rate.

- Points Earning Structures:

- 12x TYP on Hotels, Car Rentals, and Attractions booked through Citi Travel

- 6x TYP on Flights booked via Citi Travel

- 6x TYP on Dining during “Citi Nights” (Fridays & Saturdays, 6 PM – 6 AM ET)

- 3x TYP on Dining (regular hours)

- 1.5x TYP on all other purchases

- $300 Hotel Credit: Up to $300 per calendar year in statement credits for hotel bookings of 2 nights or more through Citi Travel.

- $200 Splurge Credit: Get up to $200 in annual credits at up to 2 chosen partner merchants. Current merchants include Ticketmaster, Live Nation, and American Airlines. (Gift card purchases may qualify based on data points.)

- $200 Blacklane Credit: Receive $100 credit every 6 months for Blacklane airport transfer services.

- 4 Admirals Club Passes: Four American Airlines Admirals Club passes per calendar year.

- Priority Pass Select: Cardholders receive a separate Priority Pass Select membership for lounge access worldwide. Cardholder can bring up to 2 guests for free.

- No Foreign Transaction Fees.

Disadvantages

- $595 Annual Fee: Not waived the first year. Note: Annual fees do not count toward the welcome bonus spending requirement.

Recommended Application Time

- You’re ineligible for the bonus if you’ve opened or converted to this card and received a bonus within the past 48 months.

- [8/65 Rule] You can apply for at most 1 Citi cards every 8 days, and at most 2 Citi cards every 65 days, no matter approved or not.

- Best to apply with fewer than 3 hard inquiries in the last 6 months (even though Citi’s limit is 6).

- Citi values the number of recent hard pulls a lot, we recommend you apply when there’s less than 3 hard pulls in the past 6 months (Citi generally requires less than 6 hard pulls, but this card is different).

- We recommend you apply for this card after you have a credit history of at least one year.

Summary

This card is not very compelling, with a $595 annual fee and only 80k limited-time welcome offer. The statement credits are relatively easy to use (not monthly like other cards), but even if you maximize the $300 hotel and $200 Splurge credits, it barely offsets the fee.

Unless you book a lot through CitiTravel, it’s hard to justify this card. If your main goal is to transfer TYP to travel partners, the Citi Strata Premier ($95 annual fee) is more than enough.

Related Cards

Recommended Downgrade Options

- Citi Strata: Best downgrade path to preserve TYP. Downgrading to non-TYP cards like Citi Double Cash or Custom Cash may cause existing TYP to expire in 60 days.

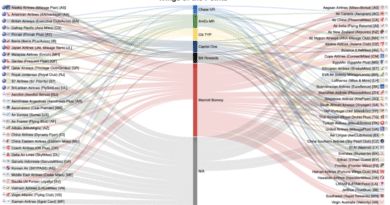

Historical Offers Chart

Note 1: The offer before 2015.4 is: earn 20k TYP after spending $2000 in the first 3 months, and another 30k after spending $3000 in the first 3 months of next year.