Should Alternative Assets Be in Your 401(k)? What Financially Savvy Americans Really Think

We asked more than 1,000 Boldin subscribers about their thoughts on the federal proposal to expand 401(k) investment options to include alternative assets, such as cryptocurrency, private equity, and real estate.

The results reveal a thoughtful mix of curiosity and caution. While many appreciate having more choice, the majority remain skeptical about whether these new options truly benefit retirement savers.

Who Answered Our Survey? Financially Savvy Retirement-Aged Investors

At Boldin, we know our users are curious, informed, and always looking for ways to make smarter choices with their money and time. They’re not passive savers — they’re active planners who want to understand the tradeoffs in every decision.

The majority of respondents were close to or already in retirement — 63% were between the ages of 56–65, while 22% were between 45–55. Just 2% were younger than 44. This age profile is significant: these are people with direct experience managing retirement accounts, weighing risk, and making choices that affect their financial independence.

Geographically, the survey reflected a broad cross-section of the United States, with representation from the South (27%), West (27%), Midwest (26%), and Northeast (20%). This balance ensures the findings aren’t skewed toward one region’s economic or cultural perspective.

These results come from people who have “skin in the game” — retirement-age investors actively managing their own financial future.

People Are Skeptical of Alternative Assets in 401(k) Accounts

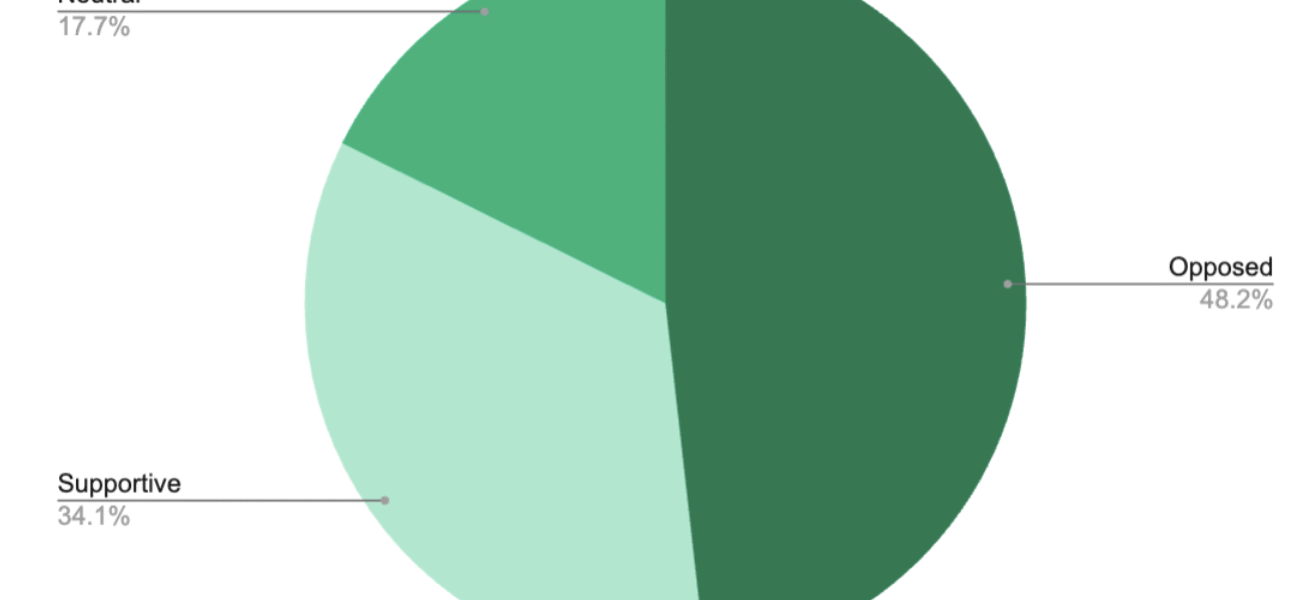

When asked about the federal proposal to allow alternative assets inside 401(k)s, the response was mixed but leaned skeptical. Nearly half (48%) opposed the idea, while only 34% supported it. Another 18% said they were neutral.

This division highlights an important truth: while some welcome new investment opportunities, many worry that adding speculative choices to retirement accounts could do more harm than good. For financially savvy Americans, stability and long-term security often outweigh the potential for high returns.

What is your overall view of Trump’s proposal to include alternative investments in 401k accounts?

- 24.36% somewhat oppose

- 24.07% strongly oppose

- 20.74% somewhat support

- 17.61% are neutral or have no opinion

- 13.21% strongly support

There is Limited Appetite for Alternative Investments in 401(k)s

The survey results make it clear: financially savvy Americans have little interest in allocating their retirement savings to alternative assets like cryptocurrency or real estate. When asked directly about their likelihood of doing so, 80% said they are “not likely” to put any portion of their 401(k) into alternatives, with only 9.5% reporting they would be “highly likely.”

Even in a hypothetical scenario where alternative investments had been available throughout their working years, the majority still expressed caution. More than three in four respondents (78%) said they either wouldn’t invest in alternatives at all (35.4%) or would limit exposure to no more than 5% of their portfolio (42.6%). Just 2% indicated they would invest as much as possible.

Together, these findings underscore a strong consensus: while alternatives may have a place for a small share of sophisticated investors, they are not viewed as a recommended or mainstream strategy for retirement savings. And, while some would have been more willing to invest a small percentage in their earlier years, when they would have had more time to recoup any losses, savvy individuals recognize the risks and prefer to keep speculative assets at the margins of their long-term planning.

How likely would you be to allocate a portion of your 401(k) to alternative assets like crypto or real estate?

- 80.37% responded not likely

- 10.01% are somewhat in between not likely and highly likely

- 9.62% are highly likely

If this proposal became law (or had been available during your working years), how likely would you be to allocate part of your 401(k) to alternative assets like crypto or real estate?

- 42.6% might invest a small percentage, but not more than 5%

- 35.4% would not invest in alternatives

- 20% would definitely invest at least 5% of my portfolio

- 2% would invest as much as I could in alternatives

Survey Respondents Are Familiar with Alternatives, but Don’t Believe Average 401k Holders Understand the Risks

Alternative investments aren’t new concepts for Boldin users. More than 80% of respondents said they were at least somewhat familiar with crypto, private equity, and real estate. Only 2% admitted they were “not familiar at all.”

However, a full 85% of respondents said most retirement savers do not understand the risk versus reward tradeoff of alternative assets. And, it’s true. Alternatives can be seen more as speculation rather than investment.

Do you think most retirement savers understand the risk vs. reward trade-offs of investing in alternative assets?

- 85.48% said no, most do not

- 9.14% are not sure

- 5.4% said that yes, most do

How Much of a 401(k) Should Go Into Alternatives?

Even among those open to the idea, most agreed that allocations should be modest. Twenty-one percent said alternatives should not be a strategy at all. Another 18% recommended less than 5% of a 401(k). Nearly a quarter (24%) said 6–10% was the right range.

These findings reinforce that financially savvy Americans are not opposed to innovation, but they want boundaries. Small allocations can provide diversification without jeopardizing core retirement savings — and that reflects a balanced, planner’s mindset.

It Isn’t Savers Who Benefit the Most

A clear majority (67%) said private equity and crypto companies would benefit most from the expansion. Just 17% believed retirement savers would come out ahead, with the rest either splitting the benefit or unsure.

This reflects a distrust that many feel toward financial institutions and new asset providers. People recognize that opening up 401(k)s to alternative assets may generate more fees and profits for companies, rather than security for savers. From Boldin’s perspective, this underscores the need for transparency and education — helping individuals evaluate who truly benefits from policy changes like this.

The Boldin Perspective

The survey reveals a consistent theme: people want choice, but they prioritize making smart, informed decisions. Boldin users see the difference between investing and speculation. They understand that while alternatives can play a role in a portfolio, they should be handled with care and backed by knowledge.

That’s the essence of Boldin: giving everyone the tools, education, and confidence to take control of their financial future. Whether it’s weighing the pros and cons of crypto or simply making sure your retirement income will last, Boldin helps you plan with eyes wide open.

About the Boldin Retirement Planner

Boldin is democratizing access to high-quality financial planning. The Boldin Retirement Planner helps real people build plans they understand and trust. The software puts you in control of your future—while our coaching, classes, and access to expert advice from CFP® professionals at Boldin Advisors ensure you don’t have to do it alone. Whether you’re planning for retirement, navigating life transitions, or just trying to make smarter financial decisions, Boldin combines clarity, confidence, and affordability to help you move forward with purpose.